The First Premier Mobile Banking App is a dynamic tool designed to simplify and revolutionize your banking experience. It's essentially your bank compacted into your smartphone, offering the convenience of managing your finances anytime, anywhere.

Whether you're checking balances, paying bills, or transferring funds, this app lets you do it all at your fingertips.

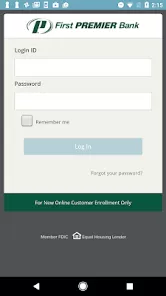

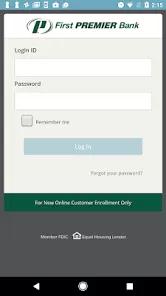

With top-notch security features, it ensures your banking activities are safe and private. Essentially, the First Premier Mobile Banking App takes the stress out of banking, giving you more control over your money.

Features of First Premier Mobile Banking App

1. Real-Time Notifications: Get instant updates on all account activities, ensuring you never miss out on any critical transactions.

2. Mobile Deposit: Deposit checks anywhere, anytime, using just your smartphone camera.

3. Quick Balance: Access your account balance in a flash, without having to log into the app.

4. Bill Pay: Set up automatic payments or pay bills manually with a few simple taps.

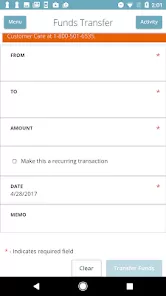

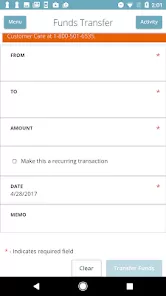

5. Funds Transfer: Move money effortlessly between accounts or send to others, all from your mobile device.

6. Budgeting Tools: Keep track of your spending and set budgets to manage your finances more effectively.

7. Mobile Loan Application: Apply for loans conveniently within the app, saving a trip to the bank.

8. ATM/Branch Locator: Find your nearest ATM or bank branch with ease, making your banking errands less of a chore.

9. Secure Access: Log in quickly and safely with fingerprint or face ID authentication.

10. Digital Statements: Embrace paperless banking by viewing your account statements right on the app.

Pros and Cons of First Premier Mobile Banking App

● Convenience: With the First Premier Mobile Banking App, you can bank on your schedule, making transactions and checking balances anytime, anywhere.

● Easy-to-use: With its intuitive design and user-friendly interface, banking has never been easier.

● Secure: Equipped with top-notch security features like fingerprint and face ID login, the app ensures that your transactions and personal data are protected.

● Money Management: The budgeting tools offer a straightforward way to track and plan your finances.

● Paperless: The online statements feature allows for easy and eco-friendly banking.

● Internet Dependence: The app requires an internet connection to function, limiting its use in areas with poor or no network coverage.

● Learning Curve: New users may need some time to understand and navigate all the features.

● Device Compatibility: The app may not be compatible with older smartphone models.

● Limited Customer Service: While the app offers convenience, complex queries may require you to visit the bank or make a phone call for resolution.

● Potential Technical Glitches: As with any digital platform, there may be occasional app downtime or technical hiccups.

Functions of First Premier Mobile Banking App

1. Facilitates Seamless Transactions: The app enables users to make secure and quick transactions, from funds transfer to bill payments, right from their device.

2. Provides Real-Time Updates: Get instant notifications on account activities, helping you stay on top of your finances.

3. Offers Hassle-Free Deposits: The Mobile Deposit feature eliminates the need for physical bank visits, as you can deposit checks using your smartphone camera.

4. Simplifies Loan Applications: Apply for a loan with a few taps on your screen, without the need to visit the bank.

5. Aids Financial Planning: With its budgeting tools, the app helps users plan and track their spending.

6. Ensures Easy Account Access: The Quick Balance feature allows users to check their account balances without logging in, saving time and effort.

7. Locates Nearby ATMs/Branches: The app guides you to the nearest ATMs and bank branches, making banking errands more convenient.

8. Enhances Security: With fingerprint and face ID login, the app heightens the security of your banking activities.

9. Promotes Eco-Friendly Practices: By offering digital statements, the app contributes to a paperless and environmental-friendly banking approach.

How to Use the First Premier Mobile Banking App

1. Download the App: Visit your phone's app store, search for 'First Premier Mobile Banking App,' and hit 'Install.'

2. Create an Account: Open the app, and follow the prompts to set up an account using your personal and account details.

3. Set Up Security: Enable the fingerprint or Face ID login for secure and quick access to your account.

4. Familiarize Yourself: Explore the app, navigate through its features like bill pay, funds transfer, mobile deposit, and more.

5. Start Banking: Begin with simple tasks, like checking your balance or making a transfer, to get comfortable with the app.

6. Set Up Alerts: Customize your account alerts for real-time updates on account activity.

7. Use Budgeting Tools: Make use of the budgeting features to effectively manage your money.

8. Apply for Loans: When ready, utilize the mobile loan application feature to apply for loans within the app.

9. Go Paperless: Opt for digital statements to contribute to environmentally friendly banking practices.

10. Find ATMs/Branches: Use the 'Find Locations' feature whenever you need to locate a nearby ATM or branch.

0

0